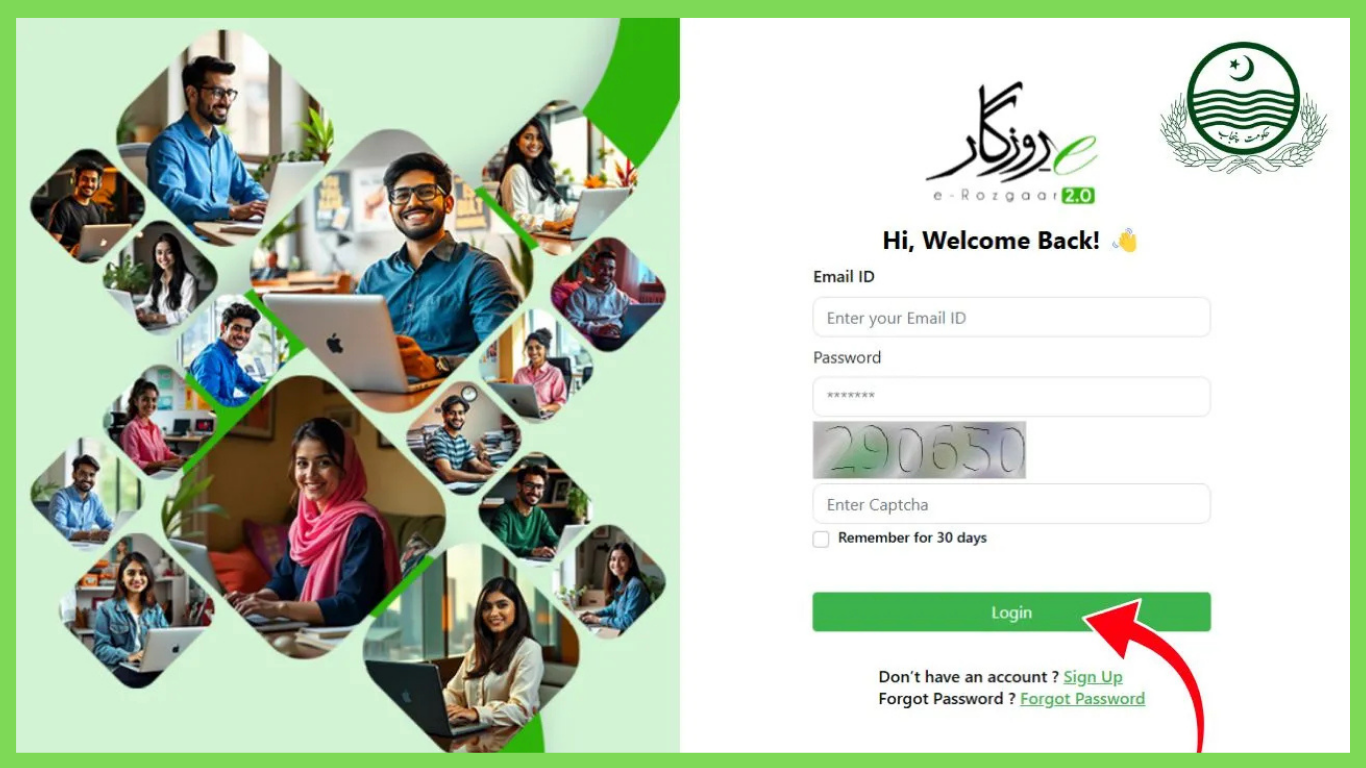

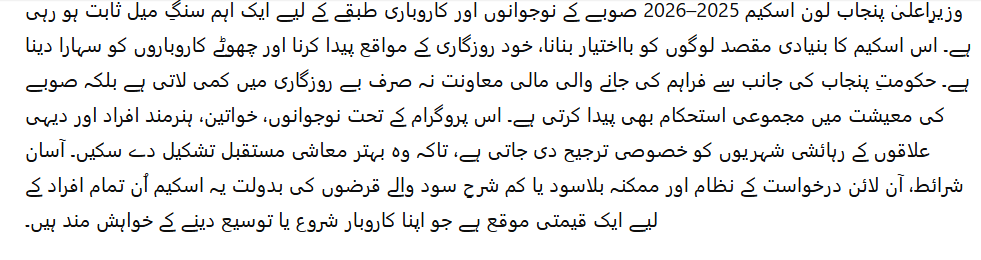

During the last ten years, Punjab’s economic outlook has been changing drastically, putting more emphasis on entrepreneurship and the development of the youth and small businesses. Keeping in view all these priorities, the Government of Punjab announced a CM Punjab Loan Scheme 2025–2026, another big financial support program to reduce unemployment, increase economic activity, and provide practical opportunities for the citizens of Punjab interested in initiating or expanding their businesses.

This scheme aspires to facilitate a wide range of segments, including young graduates, skilled workers, women entrepreneurs, freelancers, small-business owners, and those hailing from low-income or rural areas. The government is taking initiatives towards making financial resources more accessible to the general public through flexible loan structures, potential low-markup financing, and relaxed application requirements.

Here, one will find everything there is to know concerning the CM Punjab Loan Scheme 2025-2026: its purpose, benefits, eligibility, documents, business opportunities, and the step-by-step application process.

What Is the CM Punjab Loan Scheme 2025–2026?

The CM Punjab Loan Scheme 2025–2026 is a government-backed initiative that focuses on providing financial assistance to eligible residents of Punjab. The focus is on supporting:

- Small startups

- Business expansion

- Skilled-based micro enterprises

- woman-owned businesses

- Youth entrepreneurship

- Agriculture & livestock-based ventures

- Freelancers and digital workers

The scheme is expected to offer different loan tiers, with flexibility in repayment and may be subsidized or low-interest financing for lower-income applicants. It encourages self-employment and aims at reducing dependence on government jobs.

2. Objectives of the Scheme

The main objectives of the CM Punjab Loan Scheme are as follows:

2.1. Promoting Entrepreneurship

Punjab has a considerable youth population with potential but limited resources. This initiative helps convert ideas into sustainable businesses.

2.2. Reducing Unemployment

By supporting the startups and small-scale ventures, the scheme indirectly creates thousands of jobs.

2.3 Encouraging Financial Inclusion

Many people, particularly women and those in the countryside, do not have easy access to formal banking services. This scheme bridges the gap.

2.4. Business Growth & Economic Stability

A strong SME sector stabilizes economies, while loans for expansion help existing businesses upgrade, digitize, or purchase new equipment.

2.5. Supporting Innovation and Digital Skills

The funds can be utilized by freelancers, IT professionals, and digital entrepreneurs for setting up offices, purchasing equipment, and expansion of operations.

3. Salient Characteristics of the CM Punjab Loan Scheme 2025–2026

While official details may vary based on government guidelines, the scheme generally encompasses the following features:

3.1. Gruppe multiply di preside

The scheme usually offers three tiers:

- Micro Loans-for small vendors, startups, farmers, and skilled workers

- Small Business Loans-for expansion, purchase of inventory, equipment

- Medium Enterprise Loans for manufacturing, production, or agriculture machinery

3.2. Possible Interest-Free or Low-Markup Options

Smaller loans carry no interest; larger loans may carry a subsidized markup.

3.3. Flexibility in Repayment Period

Depending on the loan size, applicants may be allowed 3 to 5 years to repay the loan.

3.4. Easy Eligibility Criteria

The scheme is designed to be accessible for:

- Youth

- Women

Skilled professionals

- Small entrepreneurs

- Rural areas

3.5. Online Application System

There is usually a dedicated online portal for ease of registration, uploading of documents, and tracking of loans.

3.6. Special Quotas

Quotas may be assigned for:

- women

- Persons with a disability

- Rural entrepreneurs

- Minorities

Skilled graduates

Quantum information cannot be perfectly copied but can be transmitted from one location to another.

4. Who Can Apply? (Eligibility Criteria)

Eligibility may vary a bit for different loan categories, but in general:

4.1. Age Limit

Most applicants must be between 18 to 45 years of age.

However, some categories of business may extend the limit.

4.2. Residency

Candidates applying for a job must be the residents of Punjab and must have valid CNIC.

4.3. Educational Background

No specific degree is required, but:

Skilled workers have to present certificates.

- Students or graduates may submit educational documents

Entrepreneurs should present business knowledge.

4.4. Business Nature

The scheme supports almost all legal businesses, including: - Retail & trade

- Agriculture

- Livestock

- E-commerce

- IT services

- Production units

- Manufacturing

Transport

- Food industry

4.5. No Criminal Record

Applicants shall not be engaged in any criminal activity.

5. Required Documents

To apply successfully, you may need the following documents:

- CNIC (valid and original)

- Recent photographs

Punjab domicile or residency proof

- Bank account details

Instructions: *Business plan or Proposal

- Educational or skill certificates

- Utility bills (address verification purposes)

- Income statement (optional depending on loan size)

- Tax documents, if applicable

6. How to Apply for the CM Punjab Loan Scheme (Step-by-Step Guide)

It is designed to be simple and user-friendly in nature. A general step-by-step structure usually looks like this:

Step 1: Visit the Official Portal

Applicants will need to go to the official government loan portal while the scheme is functional.

Step 2: Create Account

Register using your CNIC and mobile number.

Step 3: Fill Out the Application Form

Provide:

- Personal information

- Business information

Income and expenses

The loan amount needed.

Step 4: Upload Documents

Attach scanned copies of the required documents.

Step 5: Submit the Application

Review and confirm the application.

Step 6: Verification Phase

The department will verify your identity and documents.

Step 7: Interview or Business Assessment

Some applicants may be called for:

- A short interview

Business feasibility evaluation

Step 8: Loan Approval & Disbursement

If approved, funds are transferred into the applicant’s bank account.

Step 9: Repayments start

Repayment typically starts after a grace period, if one is given.

7. Business Ideas Suitable for This Loan Scheme

The following are some business opportunities that fit well under this scheme:

7.1. Retail Shops

Grocery, clothes, mobile accessories, stationery, hardware shops.

7.2. Food & Beverage

Small restaurants, cafés, food carts, bakery items, fast food stalls.

7.3. Agriculture & Livestock

Dairy, poultry, goat farming, organic vegetables.

7.4. Manufacturing

Small-scale production units: plastic items, furniture, and textiles.

7.5. IT & Freelancing

Digital marketing, web development, editing studios, printing shops.

7.6 E-Commerce

Online stores, dropshipping, Amazon/Shopify businesses.

7.7. Transport & Delivery

Bike delivery, goods transport, logistics services.

8. Benefits of the CM Punjab Loan Scheme

8.1. Economic Empowerment

Provides financial independence to the youth and startups.

8.2. Zero or Low-Interest Opportunities

Helps people begin without financial pressure.

8.3. Support for Women

Special quotas encourage female entrepreneurship.

8.4. Easy access to finance

It simplifies financial inclusion for rural and low-income people.

8.5. Business Expansion

Existing businesses can upgrade equipment or increase production.

8.6. Long-Term Economic Growth

Boosts taxation, employment, exports, and technological advancement.

9. Challenges and Realities You Should Consider

While the scheme is highly beneficial, applicants must remain realistic:

- Loans require discipline in repayment.

- A strong business plan improves the chances of approval.

- Unrealistic expectations should be avoided. Funding depends on eligibility.

- Provide transparency regarding income and expenses.

10. Tips for Increasing Your Loan Approval Chances

- Prepare a clear and practical business plan.

- Explain realistic estimates of profits.

- Provide your skills, experience, or training certificates.

- Keep all documents accurate and up to date.

- Choose the business that matches your expertise.

- Keep a clean banking and financial record.

Conclusions

The CM Punjab Loan Scheme 2025–2026 opens an opportunity that is very promising for those who want to build a better future financially. Whether you are a young professional, skilled worker, small business owner, or woman entrepreneur, this scheme makes it easier to access financing, grow your ideas, and achieve economic stability.

It is a scheme with a flexible structure, broad eligibility, and supportive guidelines empowering thousands of people every year. If you have a practical business idea and determination for success, this loan program may become the foundation for your entrepreneurial journey.

APPLY NOW

Read More: